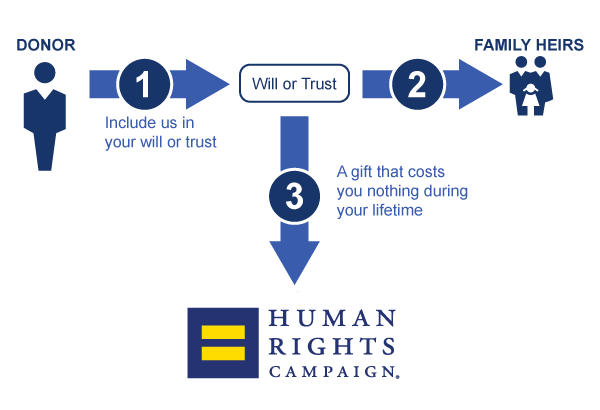

There is no immediate contribution required, and you can change your beneficiaries at any time. Once your family and friends are provided for, we hope you’ll consider leaving a gift to HRC in your will or trust or by beneficiary designation so your story is joined forever with the story of the fight for equality that is HRC.

Gifts in a Will

A gift by will or trust is one of the most popular ways to provide long-term support for HRC’s work to ensure a future of full equality. You retain control of your assets during your lifetime and can change your beneficiaries at any time. You can complete your gift with just a few sentences in your will or trust. You can arrange your bequest to provide for loved ones as well as HRC. And you will help ensure the future of the LGBTQ+ movement, regardless of the size of your gift.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

LASTING IMPACT

Your gift will create your legacy of a world where the LGBTQ+ are ensured equality and embraced as full members of society at home, at work and in every community.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

NO COST

Costs you nothing now to give in this way.

Four simple, “no-cost-now” ways to give in your will

General Gift by Will or Trust

Leaves HRC a gift of a stated sum of money in your will or trust, typically personal property or assets.

Residuary Gift by Will or Trust

Specific Gift by Will or Trust

Leaves HRC a specific dollar amount or stated fraction of your estate or a specified gift of property

Contingent Gift by Will or Trust

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to HRC or your local council contingent upon the survival of your spouse.

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in supporting a place where LGBTQ+ can achieve equality. — and it costs you nothing now.

By naming HRC as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of a future of equality and fairness for all.

You can designate HRC as a beneficiary of retirement accounts, life insurance plans, CDs, bank accounts, brokerage accounts, and other assets. It’s as simple as contacting the firm that holds your assets and asking them for a beneficiary form to fill out. Forms are often available online.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now to give

Create your legacy of equality

Types of Gifts

Retirement Plan Gift

Retirement assets are among the most heavily taxed, making them an ideal resource for charitable giving once you no longer need the assets yourself. As the charitable affiliate of HRC, the HRC Foundation is exempt from paying the taxes that might otherwise be owed. Consider making the HRC Foundation a beneficiary of your retirement assets and leaving other less-heavily taxed assets to loved ones.

To name the HRC Foundation as a beneficiary of your retirement plan, contact your bank or insurance company to see whether a change of beneficiary form must be completed.

Life Insurance Gift

Life insurance is an affordable way to leave a gift to HRC while also enjoying tax savings during your lifetime. Benefits include:

- A significant gift from disposable income at a fraction of the value.

- Tax saving can be immediately realized.

- Your donation could reduce final taxes of your estate.

- Insurance gifts transfer outside the estate.

CDs, Bank Accounts, and Brokerage Accounts

This method is one of the best and easiest ways to make a real difference for the LGBTQ+ movement. Naming HRC as the beneficiary of a certificate of deposit, a checking or savings bank account, or a brokerage account helps ensure equality for future generations.

Donor-Advised Fund (DAF) Residuals

Final distribution of contributions remaining in a Donor-Advised Fund is governed by the contract you completed when you created your fund. We hope you will consider naming the HRC Foundation as a beneficiary of your account. Or, you can name us the beneficiary a portion of the account value, leaving the remaining portion for your heirs to continue your legacy of philanthropy.